Understanding Accounting Pricing Packages: Your Path to Financial Clarity

When it comes to managing a business, financial planning and accounting are crucial elements that can dictate the success or failure of your enterprise. One of the key aspects that businesses must consider is accounting pricing packages. At Booksla.com, we are dedicated to providing outstanding financial services and financial advising tailored to meet the diverse needs of our clients.

The Importance of Accounting Pricing Packages

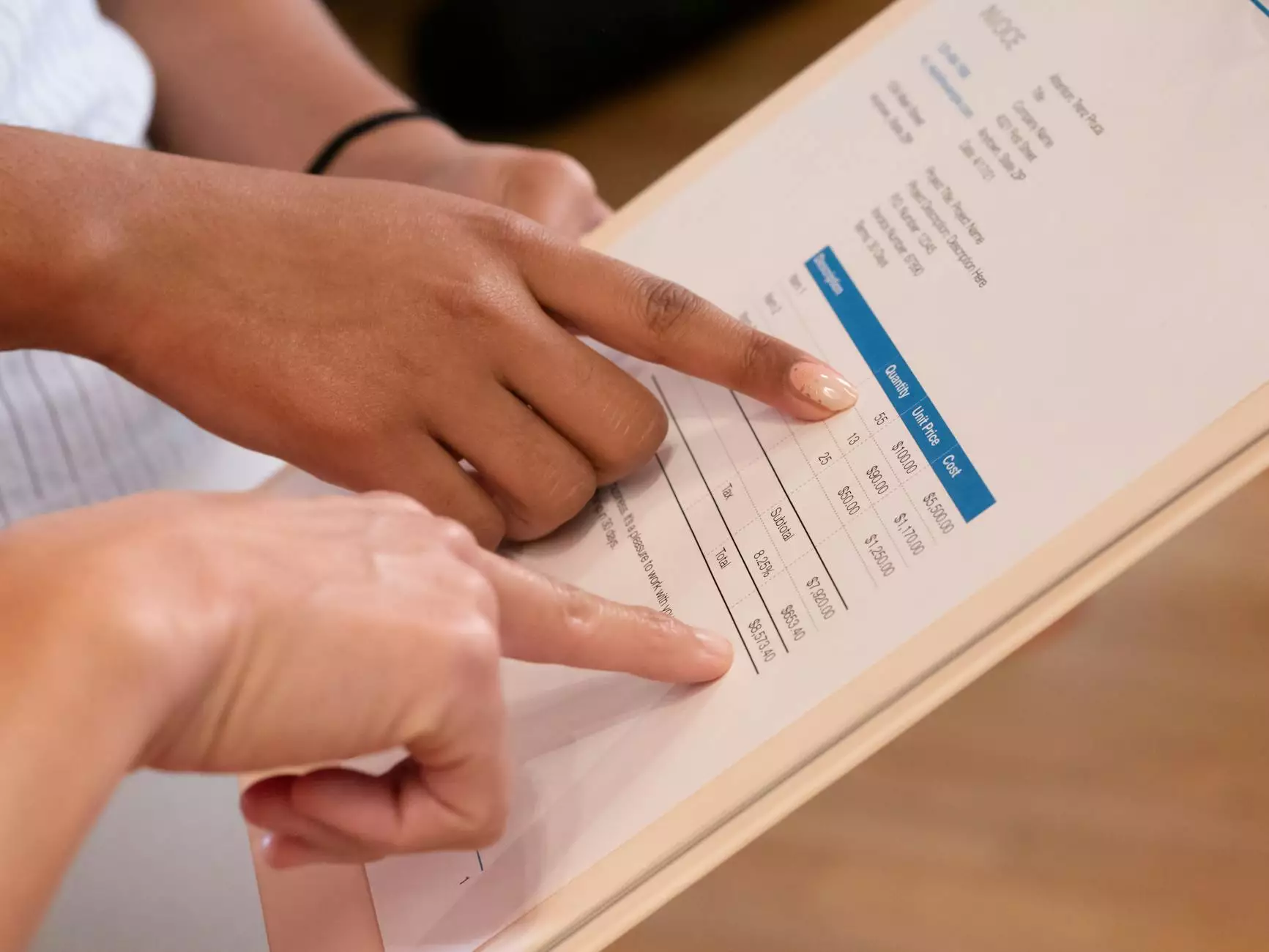

In today's competitive landscape, being transparent about pricing is essential for building trust with clients. Accounting pricing packages not only help businesses plan their budgets but also ensure they receive the necessary services without encountering unexpected costs. A well-structured pricing package will include:

- Comprehensive Services: Tailored accounting solutions that address all financial aspects of the business.

- Clear Communication: Transparent pricing that helps clients understand what they are paying for.

- Flexibility: Options that cater to businesses of all sizes and industries.

Types of Accounting Pricing Packages

Understanding the different types of accounting pricing packages available is essential for making an informed decision. Here are some common options:

1. Hourly Rate Packages

These packages charge clients based on the hours worked by the accountant. This is a common arrangement for businesses that require occasional services, such as filing taxes or specific consultations.

2. Flat Fee Packages

Flat fee packages provide a predetermined amount for particular services. This pricing model is beneficial for businesses seeking predictable expenses. Services may include:

- Monthly bookkeeping

- Tax preparation

- Year-end financial statements

3. Tiered Pricing Packages

Tiered pricing allows businesses to choose from a range of services, each at different price levels. This model offers flexibility and caters to various business needs. Common tiers might include:

- Basic services for startups

- Standard services for small businesses

- Advanced services for corporations

4. Subscription-Based Packages

With subscription-based packages, clients pay a recurring fee for ongoing services. This model is particularly advantageous for businesses that need regular accounting support.

Choosing the Right Package for Your Business

When selecting an accounting pricing package, consider the following factors:

- Business Size: Larger businesses may require more comprehensive packages.

- Industry Needs: Different industries have unique accounting requirements.

- Budget Constraints: Ensure the package aligns with your financial capabilities.

Benefits of Investing in Proper Accounting Services

Investing in professional accounting services can yield significant benefits for your business. Among the most notable are:

1. Enhanced Financial Management

Professional accountants provide insights that help you manage cash flow, budgets, and forecasts effectively. This kind of expertise can mean the difference between profitability and losses.

2. Compliance and Risk Mitigation

Accountants ensure that your business complies with tax laws and regulations, reducing risks associated with audits and penalties.

3. Informed Decision-Making

With access to accurate financial data, business owners can make informed decisions that propel their ventures forward.

4. Focus on Core Business Activities

Outsourcing accounting tasks allows you to focus on what you do best—running your business. This efficiency leads to growth and success.

How to Evaluate Accounting Firms

Once you've decided on a package type, the next step is to evaluate potential accounting firms. Here are some tips to ensure you make the right choice:

- Check Qualifications: Look for firms with certified accountants and relevant experience.

- Read Reviews: Seek testimonials and case studies from past clients to gauge their satisfaction.

- Service Offerings: Ensure that the firm provides a comprehensive range of services within the chosen package.

- Communication: Assess their willingness to provide ongoing support and answer queries.

Common Mistakes to Avoid with Accounting Pricing Packages

While considering options, be aware of several common pitfalls:

- Not Understanding the Fine Print: Always read the details of what each package includes to avoid hidden costs.

- Choosing Solely Based on Price: The least expensive option may not always provide the best value.

- Neglecting to Ask Questions: If in doubt, always inquire further to clarify any aspects of the package.

Conclusion: Making Your Choice with Confidence

In conclusion, understanding accounting pricing packages is crucial for any business owner aiming for financial stability and growth. By selecting the right package tailored to your needs, you can unlock the potential for your business's success. Remember, at Booksla.com, we are committed to delivering exceptional financial services and advice to enable our clients to thrive.

Get Started Today!

Don’t let accounting complexities overwhelm you. Reach out to our expert team at Booksla.com today, and let us help you find the perfect accounting pricing package that suits your business's individual needs!